Tax Lien States Explained: Key Differences Across the Country

Main Points

If you’ve been researching tax lien or tax deed investing, you’ve probably already hit one major roadblock: confusion. What’s the difference between a lien and a deed? Why does every state seem to have its own rules? What’s a redeemable deed, and is that the same as a hybrid?

You’re not alone. Many new investors share these same frustrations, and that’s exactly why we put this guide together.

If you’re considering tax lien or tax deed investing, one of the first and most important things to understand is this: not all states operate the same way. In fact, across the U.S., there are four distinct types of tax sale systems: tax lien, tax deed, hybrid, and redeemable deed. Each comes with its own rules, processes, and investment outcomes, which we will break down.

Here at the U.S. Tax Lien Association, we’ve helped tens of thousands of people from all walks of life successfully navigate these systems and transform their financial future, many starting with little to no investing experience. Whether your goal is to earn consistent interest, acquire real estate at a steep discount, or build long-term wealth, the right knowledge and strategy can unlock life-changing results.

In this guide, we’ll break down each system so you can confidently navigate the tax sale process, understand your rights as an investor, and choose the approach that best fits your financial goals.

Let’s dive in.

Understanding the Four Types of Tax Sale States: Lien, Deed, Hybrid & Redeemable Deed

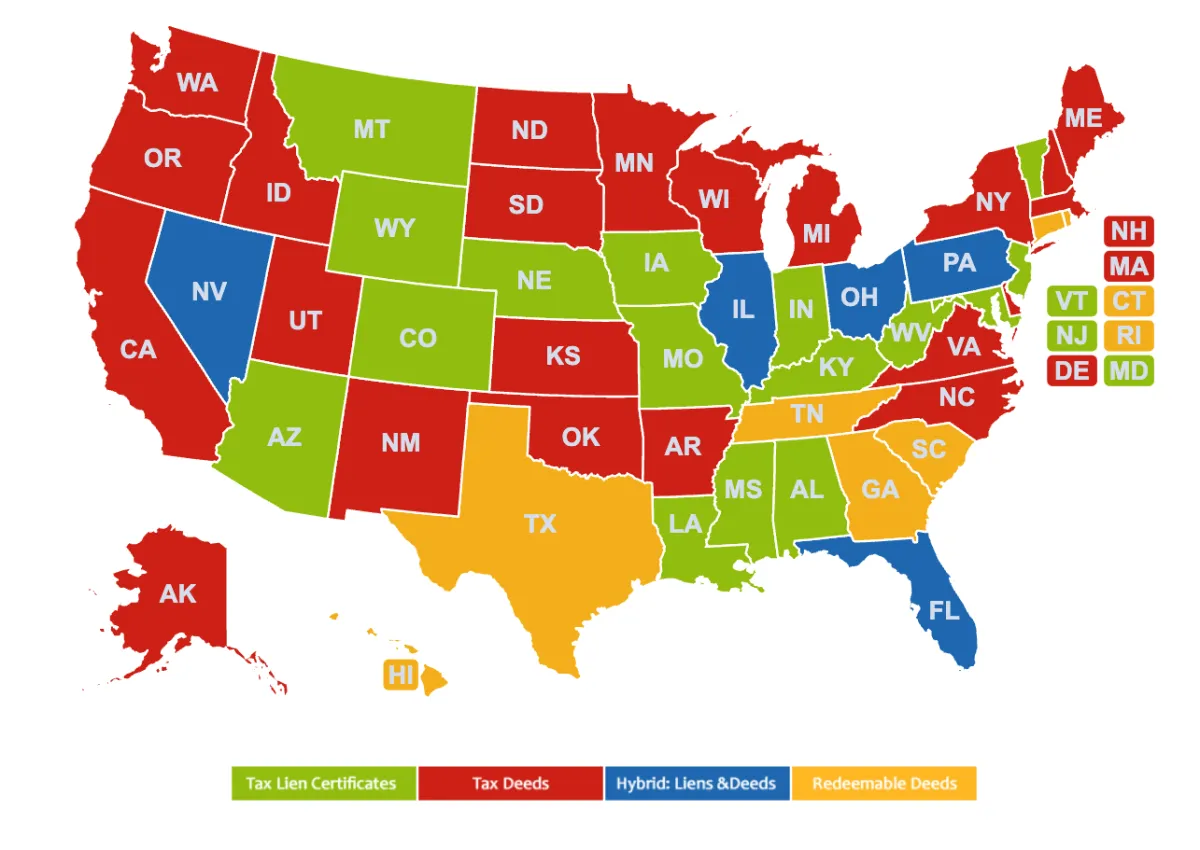

As shown on the map, there are four primary types of tax sale systems used throughout the United States. In the sections below, we’ll break each one down so you know exactly what to expect, depending on the state in which you’re investing.

Tax Lien States

In tax lien states, the government sells a lien (not the property) to investors.

You purchase the right to collect unpaid property taxes, plus interest.

The homeowner retains ownership of the property during the redemption period.

If the owner redeems the lien, you’re paid back your investment plus interest.

If it is not redeemed, you may initiate foreclosure proceedings after the redemption period has ended.

Common tax lien states: Arizona, Iowa, etc.

Tax Deed States

In tax deed states, the government sells the physical property due to unpaid taxes.

You buy the deed to the property outright at auction.

There's usually no redemption period after the sale.

The property is yours, subject to clearing the title and resolving any outstanding liens.

You may need to file a quiet title action before resale.

Common tax deed states: California, Utah, etc.

Hybrid States

Hybrid states combine elements of both tax lien and tax deed systems.

You may initially purchase a lien, but it can be converted to full ownership after a set time.

These systems are complex and vary significantly by state or even county.

Redemption terms and foreclosure rights vary.

Example: Nevada, Ohio, Florida, etc.

Redeemable Deed States

These states issue tax deeds with a redemption period: you get the deed, but the owner can still reclaim the property.

You receive the deed at auction, but cannot take full control immediately.

The owner can redeem the property by repaying taxes and interest.

If the owner redeems, you're refunded the investment plus interest.

If not, you gain full ownership after the redemption period expires.

Common redeemable deed states: Georgia, Texas, Tennessee, etc.

Interest Rates and Redemption Periods

In tax lien states, interest and redemption periods are set at the state level. Interest rates and redemption periods for lien states will therefore be uniform throughout the state.

This means that no matter where you purchase a lien in a given state, the percentage return you’re entitled to (as set by law) and the length of time the property owner has to repay the debt will remain consistent.

However, that’s where the uniformity ends.

Each county operates its own tax lien sale independently, and procedures can vary significantly from one jurisdiction to another. While the interest rate and redemption terms are locked in, counties have the freedom to establish their own auction methods and logistical details.

Counties may differ in their methods for conducting auctions, including online, in-person, or list format, as well as the opening bid, administrative fees, and willingness to negotiate municipal liens; however, opening bids at an initial tax lien auction almost always start at the amount of back taxes.

In short, investing in tax liens requires an understanding of both the state-level rules and the county-specific procedures. Knowing this distinction is critical for accurately evaluating potential investments and avoiding surprises during the bidding and redemption process.

Which Investment Is Right for You?

Now that you understand the differences between tax lien, tax deed, hybrid, and redeemable deed states, the next step is to choose the option that aligns best with your investment goals.

Are you looking for predictable, interest-based returns with minimal property involvement? A tax lien state might be your best bet.

Prefer to acquire property outright and don’t mind a little risk? Consider investing in a tax deed state.

If you’re somewhere in between or open to a longer-term redemption opportunity, hybrid or redeemable deed states may offer a strategic middle ground.

Whichever you choose, understanding your state’s system is the foundation for smart, profitable investing. Here at USTLA, our role is to guide you through this process and help you determine which strategy best aligns with your financial goals, providing clear education and expert training every step of the way.

To get started, check out our Free 3-Module Tax Lien Investing Crash Course: the perfect first step to building your knowledge and confidence.

USTLA's FREE Comprehensive

3-Module Tax Lien Investment

Online Crash Crouse

The ultimate beginner's guide to successful tax lien

certificate & tax deed investing.

Start Learning from the Comfort of Your Home Today

Featured Lessons

Vital Information Beginner’s MUST KNOW FIRST so you can Get Started Right

Lesson #1

What is Tax Lien Investing & How Can it Help You Achieve Financial Freedom

Lesson #2

How to Acquire Properties for the Back Taxes & Penalties Only

Lesson #3

How Much Investment Capital is Needed to Get Started?

As with all investments, there is always an element of risk. Even if the interest rates are written into state government law, mandated by state government law, and are regulated by state government law, there is a chance of you losing part or all of your investment. You must always try to get the best education and practice safe investing, no matter which investment vehicle you choose.