Tax Liens vs. Tax Deeds: Understanding the Critical Differences

Main Points

Real estate investing is one of the most powerful tools for building lasting wealth, especially when starting with limited capital.

Among the most overlooked but rewarding strategies are tax liens and tax deeds. While both originate from delinquent property taxes, they serve two entirely different investment purposes, and understanding those differences is critical to choosing the right path forward.

In this article, we’ll break down the key differences between tax liens and tax deeds, explain how each strategy works, and guide you in choosing the investment path that best aligns with your financial goals.

Whether you're looking to earn interest or start investing in equity-rich property ownership, we’re here to support you on your journey to financial freedom.

Let’s start by looking at one of the most accessible and misunderstood strategies: tax lien certificates.

What Exactly Is a Tax Lien Certificate?

When a property owner becomes one year delinquent on their taxes, the county government steps in to recover the unpaid amount. Rather than waiting indefinitely for the owner to pay, the county issues a tax lien certificate for sale, which represents the total amount of back taxes owed, plus any fees or penalties.

This process serves a crucial function for local governments: it provides a predictable and necessary revenue stream to fund essential public services.

Tax Liens: Earn Interest, Secured by Real Estate

Here’s how it works: when you invest in a tax lien certificate, you're not purchasing the property; you’re purchasing a first-position lien on it.

This means that you are:

Paying the taxes owed on behalf of the delinquent property owner

Earning annualized interest on that payment (often between 8% to 24%, depending on the state)

Gaining the right to foreclose on the property if the taxes remain unpaid after the redemption period

So, when property owners fail to pay their property taxes for one year, the county issues this certificate for the amount owed. By paying those taxes on behalf of the owner, you earn the legal right to collect interest. The maximum interest rates are currently between 8% and 24% per year, depending on the state.

Keep in mind, these rates are annual interest rates.

How Annual Interest Rates Work

For example, if you get a lien with 12% interest, and the property owner repays within the third month, then you only make 3%.

Some might overlook this detail, but it’s important because counties typically charge a fee for each tax lien certificate, so it’s possible to lose money if the interest earned doesn’t exceed those upfront costs.

If the property owner repays what they owe during the redemption period, you get your full investment back, plus interest. The goal here is not to acquire the property but to earn a fixed interest rate, backed by real estate.

However, relying solely on waiting out the redemption period while the taxes remain unpaid is not an effective or profitable strategy.

Breaking Down the Costs of a Tax Lien Investment

Let’s walk through a real-world example of how a tax lien investment actually works.

For example, if you purchased a tax lien certificate on a $150,000 property in a state with a two-year redemption period, and the owner fails to pay within that time, you could begin foreclosure proceedings and potentially acquire the property for just the amount of back taxes owed, often a fraction of its market value.

Let’s say the property is in a state with a 1.25% tax rate, and the owner is two years delinquent. Let’s see an example of what the costs would look like:

$1,875/year × 2 = $3,750

Plus ~10–20% in penalties, fees, and interest

Estimated total cost: ~$4,000 to $4,500

You must remember, tax lien investing is not a real estate acquisition strategy. The vast majority of property owners redeem their properties quickly, and foreclosures are extremely unlikely.

If your goal is to acquire physical property, tax deeds are the more direct and reliable path; and the good news is, we’ve got you covered. With the right guidance and tools, you can absolutely obtain physical property for just the price of the back taxes using tax deed strategies.

Tax deed investing starts the same way: with a delinquent property owner, but in this case, you're not buying a lien, you’re buying the property itself. A tax deed is an official certificate that transfers full legal property ownership from the delinquent taxpayer to the winning bidder at a public auction.

This process only takes place when a homeowner fails to pay their property taxes during the redemption period, which typically lasts anywhere from six months to two years, depending on the state. After that period ends without payment, the local government can foreclose on the property to recover the unpaid taxes.

At a tax deed auction, you are there to buy the property outright on that same day.

There is no redemption period or repayment from the homeowner; it is transferred to you, and you become the legal owner, often acquiring the property for pennies on the dollar.

In short:

Tax Liens = Earn interest, secured by real estate

Tax Deeds = Acquire property, often well below market value

Getting the Property (Even Without Going to Auction)

Here at USTLA, we’ve developed proprietary strategies that allow you to acquire tax deed properties without bidding wars or live auctions. One of our most effective systems is through "over-the-counter" (OTC) and "commissioner’s sales."

Here’s how it works:

Counties regularly have unsold tax deed properties that didn’t sell at auction.

These properties are moved to OTC lists and made available for direct purchase. You conduct research (we show you how), submit an application, and purchase the property for the amount of back taxes, fees, and interest owed.

Example:

Property market value: $65,000

Delinquent taxes owed: $4,800

Final purchase price: $4,800 — no mortgage, no auction, no competition.

This means you can start acquiring real estate with less capital, and often from the comfort of your own home.

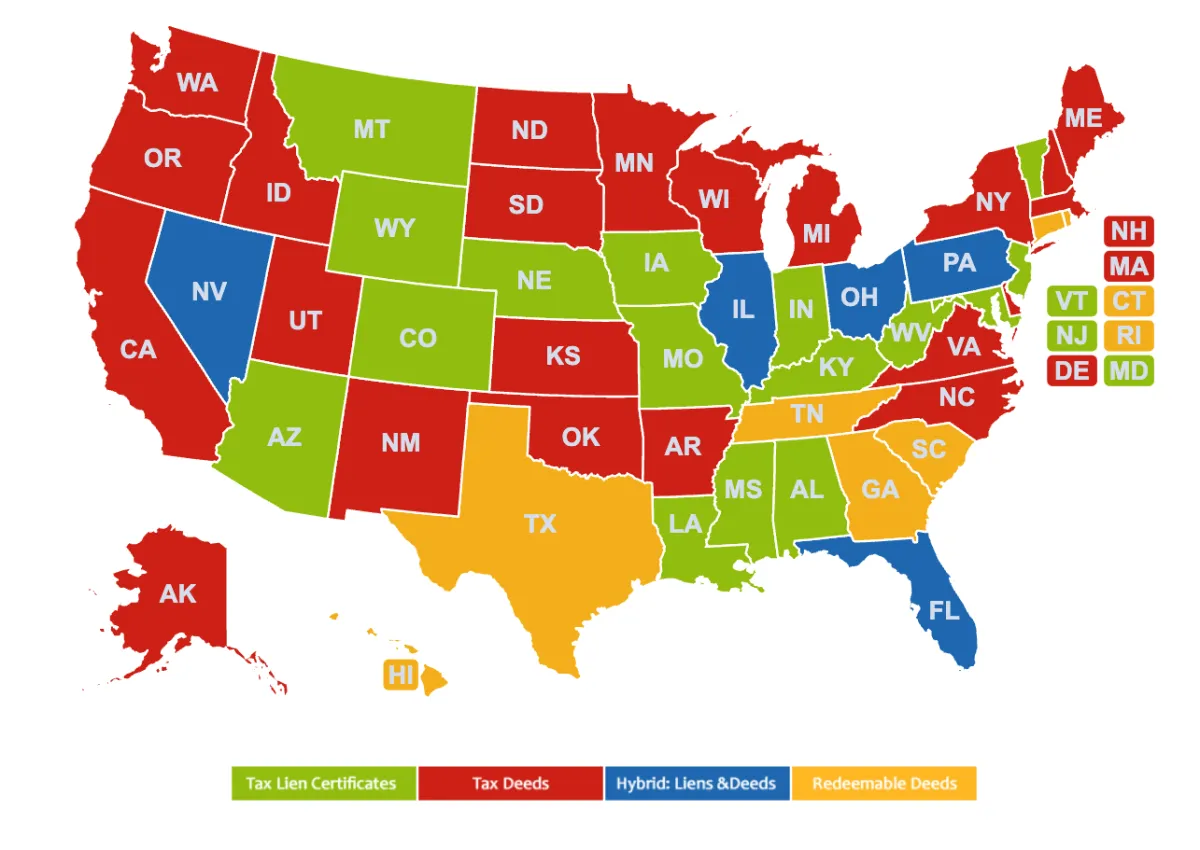

State-by-State Variations

Not every state offers the same investment model. Some are tax lien certificate states, others are tax deed states, and a select few use redeemable deeds, or a hybrid of the two. This means that the way you invest, the type of asset you acquire, and your expected return all vary depending on where you're investing.

In tax lien states, you're investing in a certificate that earns interest, while the property owner is given a legally mandated redemption period, a grace window to repay the delinquent taxes, plus penalties and interest. This redemption period varies by state, typically ranging from a few months to several years.

In contrast, tax deed states operate differently. Properties are not eligible for auction until the taxes have been delinquent for an extended period, typically around five years, depending on the state.

During that time, the property owner has every opportunity to pay off the overdue taxes and keep their property. The county doesn’t take action until the full grace period has passed without payment. Only then can the property be foreclosed on and sold at a public auction.

As the investor of a tax deed, you’re now bidding to acquire full legal ownership, often for just the amount of back taxes owed, a fraction of the property’s market value.

How You Make Money

When deciding between tax liens and tax deeds, it is important to understand where the real profit lies.

Since tax deeds are typically acquired for below market value, the potential profit they offer comes from the equity and resale potential of the property you acquire, not from interest payments like tax liens.

Both strategies offer powerful opportunities, but each serves a different purpose. Tax liens focus on secured, fixed-income returns, while tax deeds offer equity and ownership of physical property.

Ready To Get Started?

Knowing exactly what you’re doing before investing your hard-earned time and capital is essential. Whether your goal is to earn fixed-interest returns or acquire real estate at a fraction of its value, success comes down to being properly educated and strategically prepared.

Here at USTLA, we specialize in property acquisition through our proprietary Get The Property Strategies.

One of our most powerful methods is OTC Tax Deed Property Acquisition: a strategy we developed that allows you to acquire valuable real estate for only the amount of back taxes and penalties owed. You own the property free and clear, with no mortgage and no hidden encumbrances.

Even better, these properties can often be sold “as-is” for a profit without spending a dime on renovations or repairs.

Start your journey toward profitable real estate investing today with USTLA.

USTLA's FREE Comprehensive

3-Module Tax Lien Investment

Online Crash Crouse

The ultimate beginner's guide to successful tax lien

certificate & tax deed investing.

Start Learning from the Comfort of Your Home Today

Featured Lessons

Vital Information Beginner’s MUST KNOW FIRST so you can Get Started Right

Lesson #1

What is Tax Lien Investing & How Can it Help You Achieve Financial Freedom

Lesson #2

How to Acquire Properties for the Back Taxes & Penalties Only

Lesson #3

How Much Investment Capital is Needed to Get Started?

As with all investments, there is always an element of risk. Even if the interest rates are written into state government law, mandated by state government law, and are regulated by state government law, there is a chance of you losing part or all of your investment. You must always try to get the best education and practice safe investing, no matter which investment vehicle you choose.